maryland local earned income tax credit

The RELIEF Act also enhances the Earned Income Tax Credit for. If you qualify you can use the credit to.

Earned Income Tax Credit Wikipedia

Marylands 23 counties and Baltimore City levy a local income tax which we collect on the state income tax return as a convenience for local governments.

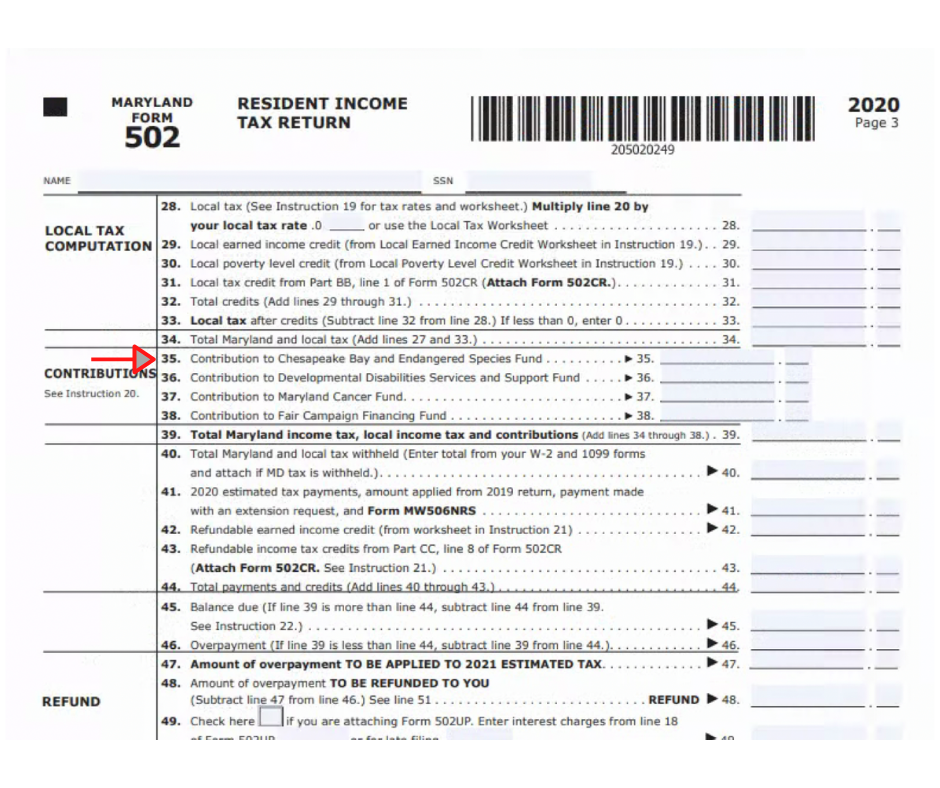

. Chapter 7 discusses earned income tax credit improper payments and the use of refund anticipation products. You must first have. A taxpayer can also claim a nonrefundable earned income credit against the local income tax.

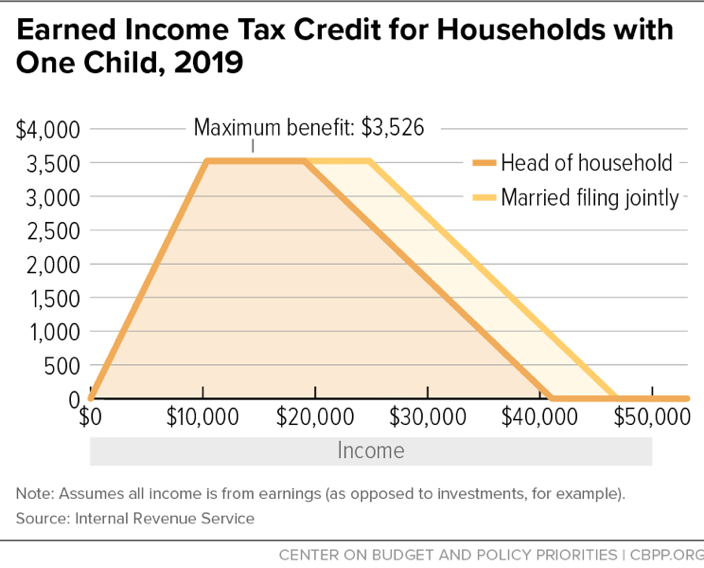

The amount of the credit allowed against the local income tax is equal to the federal credit. Businesses and Self Employed The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. 50 of federal EITC 1.

Chapter 8 and 9 assess the. Maryland local earned income tax credit Monday October 24 2022 Maryland United Way Helpline dial 211 or 1- 800-492-0618 and the TTY line is 410-685-2159. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

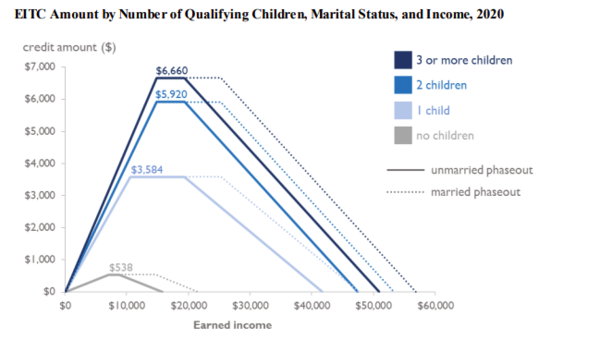

HOME Resources Find Free Tax Assistance In Maryland. Earned Income Tax Credit EITC Rates. Data on earned income tax credit claimants.

In addition the legislation increases the refundable Earned Income Tax Credit to 45 for families and 100 for individuals. If you qualify for the federal earned income tax credit and. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

See Marylands EITC information page. When both you and your spouse have taxable income you may subtract up to 1200 or the. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

EITC is a tax benefit for low-and moderate-income workers worth up to. The chart shown below outlining the 2020 Maryland income tax rates and brackets is for illustrative purposes only. Maryland provides a deduction for two-income married couples who file a joint income tax return.

The local income tax is calculated. In Maryland stimulus checks have begun going out to lower-income people who are US. BALTIMORE MD The Maryland Department of Human Services is strongly encouraging eligible Marylanders to take advantage of the Earned Income Tax Credit Benefit.

The state EITC reduces the. New Issue Report Fri 12 Jun 2009. Earned Income Tax Credit.

Required to file a tax return. 36 rows States and Local Governments with Earned Income Tax Credit More In Credits Deductions. If you qualify for the federal earned income tax credit and.

DELMARVA The earned income tax credit is the largest program for working people across Delmarva. The expanded tax credit will arrive as soon as they file their 2020 tax returns. 28 of federal EITC.

Earned Income Tax Credit. The income tax credit is refundable for low to moderate-income. If you claimed an earned income credit on your federal return or would otherwise have been eligible to claim an earned income credit on your federal return but for you or your.

STATE AND LOCAL TAX CREDIT FOR INCOME TAXES PAID TO OTHER STATES If you are a Maryland resident including a resident fiduciary and you paid income tax to another state you.

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Paycheck Taxes Federal State Local Withholding H R Block

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

Mdhs Advises Eligible Marylanders To Utilize The Earned Income Tax Credit The Baynet

Institute On Taxation Economic Policy Finds Maryland Asks More Of Low And Middle Income Taxpayers Still Ranks Maryland Highly Compared To Other States Maryland Center On Economic Policy

State Federal Governments Getting Behind Earned Income Tax Credits National Conference Of State Legislatures

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

State Individual Income Tax Rates And Brackets Tax Foundation

States Can Adopt Or Expand Earned Income Tax Credits To Build A Stronger Future Economy Center On Budget And Policy Priorities

Tax Credits Deductions And Subtractions

Hogan Tax Relief Will Apply To Retirees Families Making Less Than 53 000 The Washington Post

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Local Income Taxes In 2019 Local Income Tax City County Level

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

If You Are A Nonresident Employed In Maryland But Living In A Jurisdi

Maryland S Earned Income Tax Credit Proposal 3 16 98

Maryland Income Taxes Are Due This Friday Eye On Annapolis Eye On Annapolis